When you are buying or selling a property, the value of that property is a big deal. Not only do you need to know what to ask for a selling price, or what price to offer, but you also need to know the value so you can secure financing. And the lender also wants to know the value. So what happens when that property happens to have a solar system on its roof or on the ground? How does that impact the property value? The seller, the buyer and the financier all need an answer to this question.

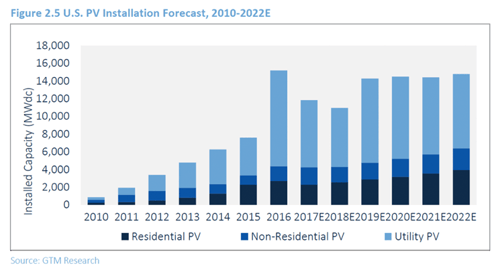

Solar energy continues to grow in popularity all over the US. In November 2017, there were 1.4 million residential systems installed in the US, and as seen in the chart below from GTM Research, the growth is projected to at least double over the next 5 years. In addition to the growth of the residential market, businesses also continue to invest in solar. This rise in popularity will continue to make assessing the value of solar a hot topic.

Chart from GTM Research - www.greentechmedia.com

Chart from GTM Research - www.greentechmedia.comTypically the companies selling and installing solar may not be the best to assess the value of an installed system. It would seem property appraisers are more suited to address market values. However many of them are just beginning to or still learning about the value of renewable energy like solar. It's important for installers like us to help accelerate that education process. So, let's jump into it!

Does a solar system add value to a property?

The simple question first; Does a solar system add value to a property? There are multiple ways of financing a solar project on a property: Options include cash, lease, loan, or PPA, and it makes a big difference which one was used.

- Let’s start with leases and PPA’s on a residential property. There likely is no additional value added to the property with these financing mechanisms. In fact, it could be a detriment to the value. The reason? Leases and PPA’s are long-term commitments with set prices that were likely compared to utility rate projections for savings when the agreement was signed. If the utility rate escalation does not follow projections, the lease agreement or PPA could make you “upside down”. Buyers should be wary of assuming these long-term agreements. If utility rates climb quickly, then the lease or PPA may have some additional value, but rarely would this impact the property's appraised value.

- For solar on a residential property that was paid with cash or a loan, the story is different. The energy output definitely has a cash benefit and adds value. So it’s been pretty firmly established that owning a solar system does add value to your home when you go to sell it.

- For commercial systems, if the system is owned (or financed), then yes, the system adds value. If financed, the loan may need to be paid off at the time of the property transaction.

Where does the value of solar come from?

The value of solar comes from the reduction of an expense, the potential income generation, and the sustainability factors (both financial and environmental).

- The primary monetary benefit is usually reduced electricity costs for the property.

- In many states, an owner of a solar system will receive green energy incentive payments of some type, usually from the sale of SREC’s (Solar Renewable Energy Certificates). This provides income to the system owner from those required to buy credits, usually utility companies. This market can be very volatile in some states.

- The system adds value to your house or business property because you have a “money printing” machine on the property.

- Reduction of your carbon footprint, reduced CO2, demonstrates social responsibility and environmental friendliness. This can be marketed by a business to appeal to environmentally conscious customers, however, it can be difficult to quantify the true monetary value.

How do we determine the “added” value of a solar system?

This has been and will continue to be widely debated. Early studies showed a willingness to pay 4% more for a property with solar, yet the data was limited and many real estate professionals argued solar did not add value to properties. In 2008, a study in California showed homes sold faster with solar panels, with a premium of $15K for an average sized residential system. In 2015 a Berkeley Lab study in examined 8 states over 11 years and found on average home buyers were willing to pay $4 per watt more for a house with solar. That means an average sized 6 kW residential system would add $24,000 in added value to the property. And while I don’t have current statistics for 2018, I can assure you that it is likely lower now as costs have dropped since 2015.

In addition to having the research noted above, SEIA (Solar Energy Industry Association) suggests using one of the following 3 methodologies to calculate the added value of solar.

The Income Approach

The Income Approach takes the expected energy cost savings minus the ongoing operating costs. This is often referred to as the avoided cost which is the billing rate of the utility. Advantage – this is the rationale that drives most solar purchase decisions.

The Cost Approach

The Cost Approach represents the current cost to replace the solar system. This reflects current pricing of a system, but solar systems depreciate over time, so that must be taken into account. Since solar prices have fallen over the years, you do not want to pay more than a new system costs. And incentives often affect the cost approach. In other words, buyers are willing to pay replacement cost AFTER incentives. In 2010, residential pricing was $6.75/ Watt. In 2016, closer to 3.25/Watt. The cost approach takes into account the age and quality of the installation.

The Comparable Sales Approach

The Comparable Sales Approach is when comparable properties in a geographic area are matched against each other - one with solar and the other without solar. This is a common appraisal method for real property and the more solar that is installed the better this method should work. However, in many areas, there may not be enough installations yet for this to work well. And then there is always location, location, location. It may be hard to factor out other contributing factors to value variation when doing property comparisons.

Use These Tools To Help Determine The Value

The reality is much has been written and debated about the impact of solar on the value of a property. There are many underlying determinants like age, energy production or output, quality of the hardware and install, warranties, production guarantees, and so on. This can seem a bit overwhelming, but fortunately, there are tools that can help, such as:

- PVValue - This website gives an excellent in-depth analysis that is accepted by most property appraiser organizations.

- Savenia Home - This is a solar valuation calculator developed in cooperation with the US Dept of Energy’s SunShot Initiative and requires fewer inputs than PV Value to calculate the value.

Both are very good online calculators for determining a solar system’s value. Solar professionals like Paradise Energy Solutions can also provide you with a value assessment on a system, including system testing to verify functionality and performance. And keep in mind that when calculating the value you must also consider projected maintenance and insurance costs. Our company always projects these in our proposal cash flows, but not everyone does.

I’ll wrap this blog up with a quote from Marjorie Youngren's article Ask the Realtor: How do solar panels affect a home’s resale value? “There is so much detailed information on this topic I could go on forever, but the more that I investigate, the more I am convinced solar can save you money on energy, look sleek, and even boost the resale value.”

We agree with Marjorie and would love to talk with you and answer your questions about assessing the value of a solar system.