For years, the Solar Investment Tax Credit (ITC) has been a valuable incentive for individuals and businesses interested in investing in solar energy. However, with the passing of the Inflation Reduction Act (IRA) in August 2022, the ITC has received a significant upgrade.

Replacing the initial Solar Investment Tax Credit from the 2000s and 2010s, the new solar panel tax credit introduced in the IRA provides even greater benefits for those seeking to reduce the costs of installing a solar energy system.

Here's what is covered in this blog:

- The residential solar tax credit

- The commercial solar tax credit

- The direct pay option for nonprofits and municipalities

- When the tax credit can be used

- The energy storage tax credit

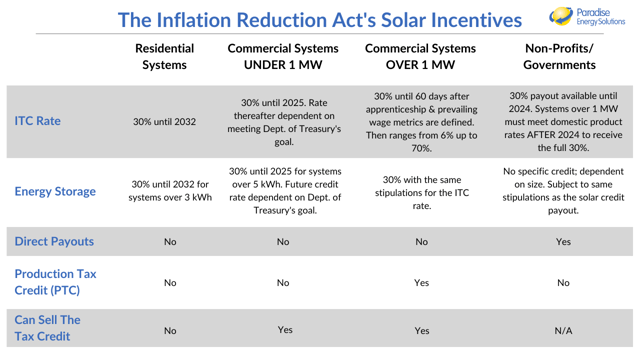

The Inflation Reduction Act's Solar Tax Incentives

With the last ITC, Americans saved less and less on solar installations each year. The Inflation Reduction Act’s federal solar tax credit of 2022 sets a new standard for ten years (until 2032). And it benefits many solar customers.

While the IRA offers tax incentives for solar across the board, benefits differ depending on the size of your system and the type of customer you are (residential vs. commercial vs. non-profit).

Below, we’ll explore how the Inflation Reduction Act will impact anyone looking to install a solar system. While the IRS has released specifications for the add-ons, it’s not yet 100% clear how these incentives will apply. Until then, here’s how the industry interprets solar’s federal tax credit.

The Residential Solar Tax Credit

The residential investment tax credit is a straightforward and beneficial incentive for homeowners looking to invest in solar energy. Currently set at 30% across the board until 2032, this tax credit allows homeowners to reduce their tax liability by 30% of the total installation cost.

One of the great advantages of this tax credit is that homeowners don't have to worry if they can't utilize the entire credit in the first year. Homeowners have the advantage of carrying the credit forward until it is fully utilized, with a deadline of 2032. It's important to note that the residential tax credit cannot be used to recapture taxes from prior years.

Unlike the commercial tax credit, which allows businesses to transfer (sell) the credit to a third party, homeowners are not eligible for this option. The residential tax credit is exclusively available to the homeowner who installed the solar system.

The residential investment tax credit provides homeowners with a substantial financial benefit, allowing them to reclaim a significant amount of money that would otherwise be paid to the IRS.

The Commercial Solar Tax Credit

Systems Under 1 Megawatt (MW) AC Power Businesses and Farmers)

Anyone installing a solar system smaller than 1 MW of AC power will receive a tax credit of 30%. This will be the case for homeowners until 2032. For businesses of most sizes and agricultural producers, this rate is guaranteed until 2025.

These projects can also qualify for additional 10% adders if certain conditions are met. Those adders are:

An additional 10% tax credit is added if the project is built on a brownfield site or community with coal plant closures. Watch the video below to learn more and use this map to determine if you're in an area that qualifies.

An additional 10% tax credit is added if the project uses US-made components, including:

- 100% domestically-produced steel and iron components for structural items such as the racking, posts, etc.

- Solar panels and/or solar inverters that consist of at least 40% domestically-produced components by dollar volume until 2027. Then, the project must use 55% to qualify.

An additional 10% tax credit is added if the project is installed in a low-income area or on tribal land (and is under 5 MW).

An additional 10% tax credit is added if the project energizes a low-income residential building or economic benefit system (and under 5 MW).

The tax credit will cover interconnection costs for projects under 5 MW.

Systems Over 1 Megawatt (MW) AC Power (Solar Developers, Utilities, XL Industrial)

For now, systems larger than 1 MW will receive the full 30% tax credit. But once the IRS issues its guidelines, the rate will vary based on how well the project meets a series of metrics.

The tax credit begins at 6% across the board but can increase to 70% if certain conditions are met:

- The 6% can increase to 30% if the project meets apprenticeship (requirement of the installation company) and prevailing wage requirements.

- An additional 10% tax credit is added if the project is built on a brownfield site or community with coal plant closures.

- An additional 10% tax credit is added if the project uses US-made components (see below for more details)

- An additional 10% tax credit is added if the project is installed in a low-income area or on tribal land (and is under 5 MW).

- An additional 10% tax credit is added if the project energizes a low-income residential building or economic benefit system (and under 5 MW).

- The tax credit will cover interconnection costs for projects under 5 MW.

These large systems can also choose a production tax credit (PTC) over the ITC. This credits system owners based on how much electricity the system produces. The current rate is $0.026/kWh but will increase with inflation.

More on the Domestic Component Requirements

Commercial systems of all sizes can qualify for an additional 10% tax credit if a specific amount of domestic components are used. While we have specifications on this, it will take a few years to know exactly how this will work out.

For now, 100% of the steel or iron on the project must be made in the US. If this isn’t met, the project won’t qualify for the 10%. Additionally, at least 40% of the dollar value of the components that make up your solar panels and inverters must be made in the US. This rate jumps up in 2027. By then, 55% of the components on your equipment will have to be domestically produced to qualify for the extra 10%.

Solar panels or inverters that are just assembled in the US but made from foreign-made parts won’t count towards that 40%. As of now, very few solar panels or inverter brands would qualify for this add-on.

It seems that the ancillary equipment like the wiring, nuts, bolts, and clamps won’t count to the 40% carve out.

The burden of proving that 40% of components on a product are made domestically would fall on the manufacturer of these items. They would then pass that information to the installer, who would pass that on to you as the customer. It’ll be your responsibility to save this information and use it when you file taxes.

What Happens if you don’t have the tax liability to use the tax credit?

The IRA allows businesses that don’t have tax liability the option to transfer (sell) their tax credit. For example, you could sell your solar tax credit for $0.90 on the dollar. You’d be able to cash in on 90% of the tax credit you wouldn’t otherwise be able to. The organization or person that bought your credit gets a 10% savings for whatever portion of their taxes your solar credit covers.

There are still details that need to be worked out around the transfer market, but here's what we know as of the most recent guidance issued on June 14, 2023:

- The system must be registered with the IRS by the owner. The IRS will provide a registration number that will follow the sale. This number will be needed by the transferee when they file their taxes.

- The tax credit can be split and sold to multiple parties – i.e., 25% to one party and 75% to another

- The credit can only be transferred once

- The sale must be a cash transaction

- It cannot be sold to a related party - i.e., father to a son or between business partners

- The transferee is responsible for any tax liability triggered by a recapture event. A recapture event will occur when the system owner (transferor) sells the system within the first six years.

Non-Profits, Municipalities, Local Government Agencies, & More: Tax Liability Is No Longer Required To Use The Solar Tax Credit

With the previous ITC, solar owners needed tax liability to take advantage of the savings. This made going solar more difficult for non-profits, government buildings, and other organizations without tax liability.

Thankfully, the IRA changes this.

For non-profits and state and local governments, the IRA allows for the direct payout for all of or a portion of the solar tax credit. Here are the conditions:

- For systems under 1 MW, tax-exempt entities will receive 100% of the 30% tax credit. Systems larger than 1 MW will receive the 30% if they meet the domestic manufacturing requirements (which have not been defined at this time).

- Starting in 2024, if the domestic manufacturing requirements are not met on 1MW+ systems, they’ll receive: 90% of the ITC in 2024, 85% in 2025, and 0% in 2026

- These organizations are eligible for the bonus add-ons ( 10% for domestic content, 10% for installing in an energy community, and 10% if installed in a low-income area)

Filing for the direct payment must be completed at the end of the next tax deadline, which for 501(c) non-profits is in May of the following year. It could take up to one year or more to receive the direct payment.

The selling (or transferring) of the tax credit is a benefit only available to organizations that do not qualify for the direct payment option.

What Year's Taxes Does The Solar Tax Credit Apply To?

In some cases, you may want to carry your tax credit forward to upcoming years. Under the current ITC, this is possible within a specific set of years.

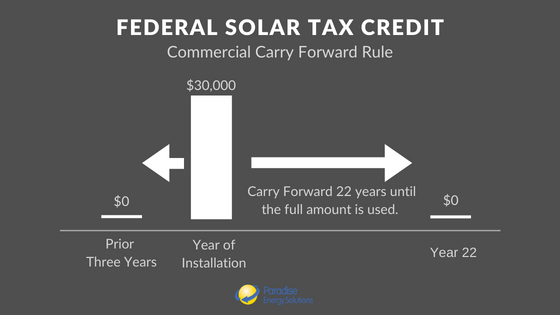

Commercial Solar Tax Credit Carry Forward Rule

Businesses have the opportunity to claim the tax credit for taxes owed in the previous three years or for the next 22 years.

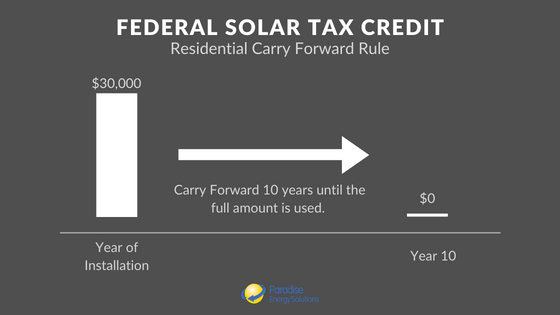

Residential Solar Tax Credit Carry Forward Rule

Homeowners have the benefit of carrying the tax credit forward for up to ten years until it is fully utilized.

Energy Storage & Solar Batteries: Use The Tax Credit With or Without Solar

Previously, the ITC only applied to battery backup systems that were installed within one year of a solar energy system.

With the IRA, you can take full advantage of the tax credit if you install a battery system regardless of when — or if — you install solar. So whether you installed solar years ago or never have, you can still save a significant amount.

To qualify, energy storage systems must be over 5 kWh. This credit is also dependent on the US Department of Treasury’s energy reduction goal.

Should You Wait If You're Thinking About Installing Solar Panels?

The IRA has ushered in what is perhaps the biggest change for renewable energy in history. But as the finer details get ironed out, it may seem wise to wait to install a system. But is that the right choice?

Full disclaimer: we’re solar installers, so even with the very best intentions, we have an implicit bias to say it’s always a good time to go solar. But consider this:

- All systems under 1 MW will qualify for at least the 30% tax credit until 2025 for businesses and 2032 for homeowners.

- Energy prices continue to increase across the country at a dizzying pace.

- For the first time in history, the cost to install solar increased in 2021. This is due to continued supply chain issues, inflation, and demand outpacing supply. We expect this could continue to be an issue as demand created by the IRA ramps up.

- For the first time in history, the cost to install solar increased in 2021. This is due to continued supply chain issues, inflation, and demand outpacing supply. We expect this could continue to be an issue as demand created by the IRA ramps up.

- Each day you go without solar is a day you have to pay the utility company for each kilowatt-hour you use.

Given those conditions, we’d advise those interested in going solar to get the ball rolling as soon as possible. The IRA is likely to increase the demand for solar energy, but the already-low supply of solar components won’t change anytime soon. That could mean increases in the cost to go solar would outpace the potential savings from a more ironed-out IRA (if that’s even the case).

Overall, a day with solar energy saves you more money than a day without solar energy. Request your free quote to learn how solar will help you Save With Every Sunrise!

Originally published December 7, 2016, updated July 14, 2023.